personal loans for bad credit ohio

Add a review FollowOverview

-

Founded Date August 24, 1955

-

Posted Jobs 0

-

Viewed 13

Company Description

Easy Places to Get a Personal Loan with Bad Credit

When it comes to securing a personal loan, having bad credit can feel like a significant barrier. However, there are several options available for individuals who may not have the best credit history. Understanding where to look and what to expect can make the process much easier. This article will explore various avenues for obtaining a personal loan with bad credit, including online lenders, credit unions, peer-to-peer lending, and more.

Understanding Bad Credit

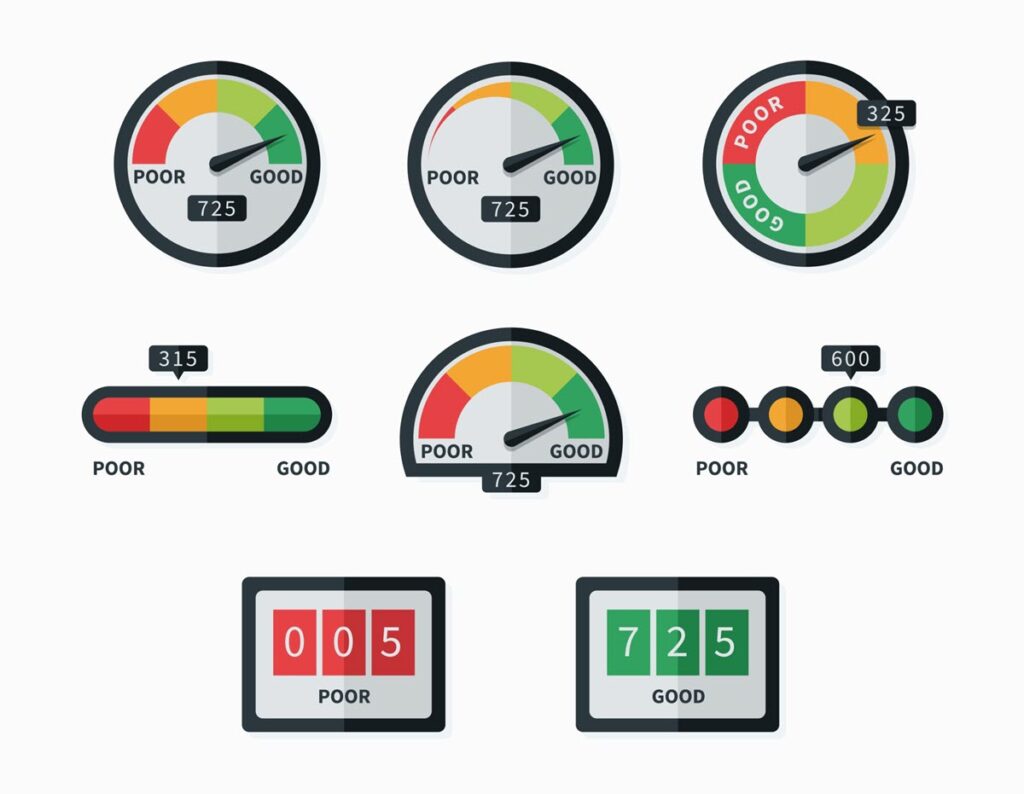

Before diving into the options, it’s essential to understand what constitutes bad credit. Credit scores typically range from 300 to 850, with scores below 580 often considered poor. Factors that contribute to a low credit score include missed payments, high credit utilization, bankruptcy, and accounts in collections. While these factors can make it more challenging to secure a loan, they do not make it impossible.

1. Online Lenders

One of the most accessible options for individuals with bad credit is online lenders. Many online lending platforms specialize in offering loans to those with less-than-perfect credit. These lenders often have more flexible requirements than traditional banks. Some popular online lenders include:

- Avant: Avant is known for its personal loans for borrowers with credit scores as low as 580. They offer quick funding and a straightforward application process.

- Upstart: Upstart uses alternative data, such as education and job history, in addition to credit scores, which can benefit those with limited credit history or bad credit.

- OneMain Financial: OneMain Financial provides personal loans to individuals with bad credit and offers a personalized approach to lending.

2. Credit Unions

Credit unions are non-profit financial institutions that often provide more favorable loan terms than traditional banks. They are known for their community focus and may be more willing to work with individuals who have bad credit. To access loans from a credit union, you typically need to become a member, which often requires you to live, work, or worship in a certain area or meet specific membership criteria.

Credit unions may offer lower interest rates and fees compared to other lenders, making them an excellent option for those with poor credit. Some credit unions even have programs specifically designed to help members rebuild their credit.

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors willing to fund their loans. This can be an appealing option for those with bad credit, as investors may be more willing to take a risk on a loan than traditional financial institutions. Some popular P2P lending platforms include:

- LendingClub: LendingClub allows borrowers with credit scores as low as 600 to apply for personal loans. The platform offers a variety of loan amounts and terms.

- Prosper: Prosper is another P2P lending platform that caters to individuals with varying credit scores. Borrowers can receive funding quickly, often within a few days.

4. Secured Personal Loans

If you have bad credit, you might consider a secured personal loan. This type of loan requires collateral, such as a savings account, vehicle, or other assets, which reduces the lender’s risk. Because the loan is backed by collateral, lenders may be more willing to approve borrowers with bad credit.

While secured loans can be easier to obtain, it’s crucial to understand the risks involved. If you fail to repay the loan, the lender can seize your collateral. Therefore, it’s essential to ensure that you can meet the repayment terms before pursuing this option.

5. Co-Signer Loans

Another option for obtaining a personal loan with bad credit is to apply for a loan with a co-signer. A co-signer is someone with good credit who agrees to take responsibility for the loan if you default. Having a co-signer can improve your chances of approval and may even result in a lower interest rate.

When considering a co-signer loan, it’s essential to choose someone you trust and who understands the financial commitment involved. Both parties should be aware of the potential risks, as missed payments can negatively impact both the borrower’s and the co-signer’s credit scores.

6. Family and Friends

Sometimes, the best option for a personal loan is to turn to family or friends. Borrowing from loved ones can offer more flexible repayment terms and lower or no interest rates. However, it’s essential to approach this option with caution, as mixing finances with personal relationships can lead to tension or conflict.

If you decide to borrow from family or friends, it’s a good idea to put the agreement in writing. Clearly outline the loan amount, repayment schedule, and any interest charges to avoid misunderstandings in the future.

7. Local Banks and Community Lenders

While traditional banks may be less willing to lend to individuals with bad credit, local banks and community lenders may offer more personalized service and flexibility. These institutions often have a better understanding of the local economic landscape and may be more willing to work with borrowers who have a less-than-perfect credit history.

When approaching local banks or community lenders, be prepared to explain your financial situation and demonstrate your ability to repay the loan. Providing documentation of your income, expenses, and any efforts to improve your credit can help strengthen your case.

Conclusion

Securing a personal loan with bad credit may require some extra effort, but it is possible. If you have any issues pertaining to where and how to use easy places to get a personal loan with bad credit, you can get hold of us at our website. By exploring various options such as online lenders, credit unions, peer-to-peer lending, secured loans, co-signer loans, and even borrowing from family or friends, you can find a solution that meets your financial needs. Remember to carefully consider the terms and conditions of any loan and ensure that you can manage the repayment to avoid further damaging your credit. With the right approach and resources, you can successfully obtain a personal loan and work towards rebuilding your credit.